dallas texas local sales tax rate

The current total local sales tax rate in Dallas County TX is 6250. The Dallas sales tax rate is.

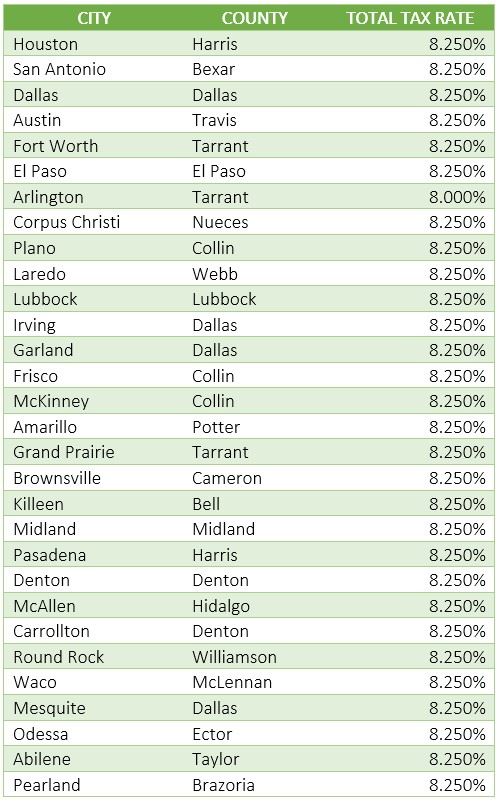

Texas Sales Tax Rates By City County 2022

What Is The New Car Sales Tax In San Antonio Texas.

. Local Rules Civil Courts. 33 rows Texas has a 625 sales tax and Dallas County collects an additional NA so the minimum. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction along with the effective date and end date of each tax.

Dallas TX Sales Tax Rate. This report shows jurisdictions adopting new or changed sales tax rates in the past 14 months. Download and further analyze current and historic data using the Texas Open Data Center.

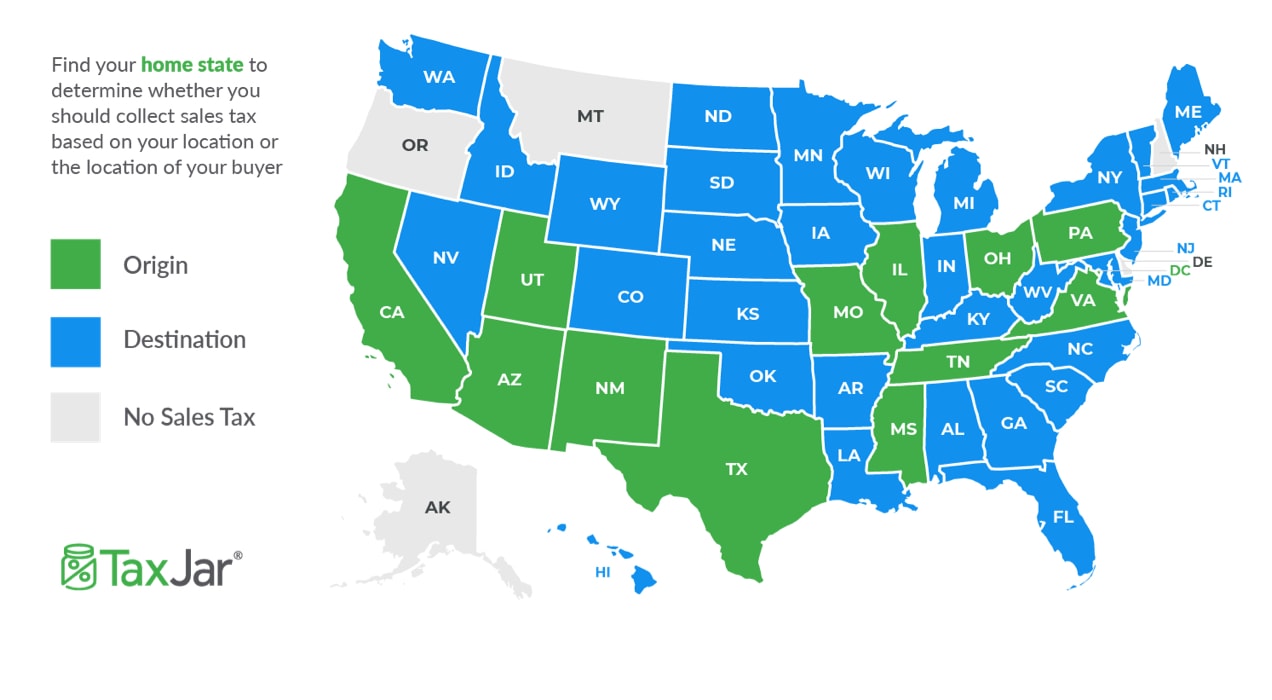

While many other states allow counties and other localities to collect a local option sales tax Texas does not permit local sales taxes to be collected. The Dallas Texas sales tax is 625 the same as the Texas state sales tax. Local Code Local.

TEXAS SALES AND USE TAX RATES April 2022. Downtown Administration Records Building 500 Elm Street Suite 3300 Dallas TX 75202 Telephone. The base Dallas Texas sales tax rate is 1 and the Dallas Texas sales tax rate Dallas MTA Transit is 1 so when combined with the Texas sales tax rate of 625 the Dallas Texas sales tax rate totals 825.

City sales and use tax codes and rates. The minimum combined 2022 sales tax rate for Dallas Texas is. The total local sales tax rate in any one particular location that is the sum of the rates levied by all local taxing authorities can never exceed 2 percent.

214 653-7811 Fax. The Dallas Sales Tax is collected by the merchant on all qualifying sales made within Dallas. Dallas MTA Transit stands for Metropolitan Transit Authority of Dallas.

Rate histories for cities who have elected to impose an additional tax for property tax relief Economic and Industrial Development Section 4A4B Sports and Community. Average Sales Tax With Local. Local Sales Tax Rate Information Report.

If you need access to a database of all Texas local sales tax rates visit the sales tax data page. Combined Area Sales and Use Tax In Texas the combined area city sales tax is collected in addition to state tax and any other local taxes transit county special purpose district when applicable. Real Estate for Sale.

Transparency Contact Us Help. Texas Comptroller of Public Accounts. The County sales tax rate is.

The 825 sales tax rate in. Texas has 2176 cities counties and special districts that collect a local sales tax in addition to the Texas state sales tax. The Texas state sales and use tax rate is 625 percent but local taxing jurisdictions cities counties special-purpose districts and transit authorities also may impose sales and use tax up to 2 percent for a total maximum combined rate of 825 percent.

Texas has a 625 sales tax and Dallam County collects an additional NA so the minimum sales tax rate in Dallam County is 625 not including any city or special district taxes. Groceries prescription drugs and non-prescription drugs are exempt from the Texas sales tax. 214 653-7888 Se Habla Español.

Texas has 2176 special sales tax jurisdictions with local. If you are buying a car for 2500000. The rates shown are for each jurisdiction and do not represent the total rate in the area.

Dallas Texas Auto Sales Tax Rate. Denton TX Sales Tax Rate. Lauras Income Tax Services El Monte.

Terminate or Reinstate a Business. Fast Easy Tax Solutions. Texas has state sales tax of 625 and allows local governments to collect a local option sales tax of up to 2.

The current total local sales tax rate in Dallas GA is 7000. TEXAS SALES AND USE TAX RATES April 2022. Taxes Home Texas Taxes.

Sales Tax Permit Application. You will be required to collect both state and local sales and use taxes. The current total local sales tax rate in dallas tx is 8250.

Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 825. The Texas state sales tax rate is 625 and the average TX sales tax after local surtaxes is 805. Dallas Co 2057217 010000 082500 Allentown 067500.

2022 Tax Rates Estimated 2021 Tax Rates. The Dallas Texas sales tax is 825 consisting of 625 Texas state sales tax and. 4 rows Dallas collects the maximum legal local sales tax.

Name Local Code Local Rate TotalRate Name Local Code Local Rate TotalRate AmherstLamb Co 2140010 012500 075000 ArcherCity 2005023 015000 082500. The Texas sales tax rate is currently. There are a total of 981 local tax jurisdictions across the state collecting an average local tax of 1681.

This is the total of state county and city sales tax rates. The December 2020 total local sales tax rate was also 7000. This table shows the total sales tax rates for all cities and towns in Dallam County including all local taxes.

Ad Find Out Sales Tax Rates For Free.

Car Sales Tax In Texas Getjerry Com

Tax Rates Richardson Economic Development Partnership

Round Rock Suing To Protect Millions It Reaps From Online Sales Taxes

Texas Sales Tax Guide And Calculator 2022 Taxjar

Was Exxon Mobil S Tax Rate Last Year Really 5 1

How To File And Pay Sales Tax In Texas Taxvalet

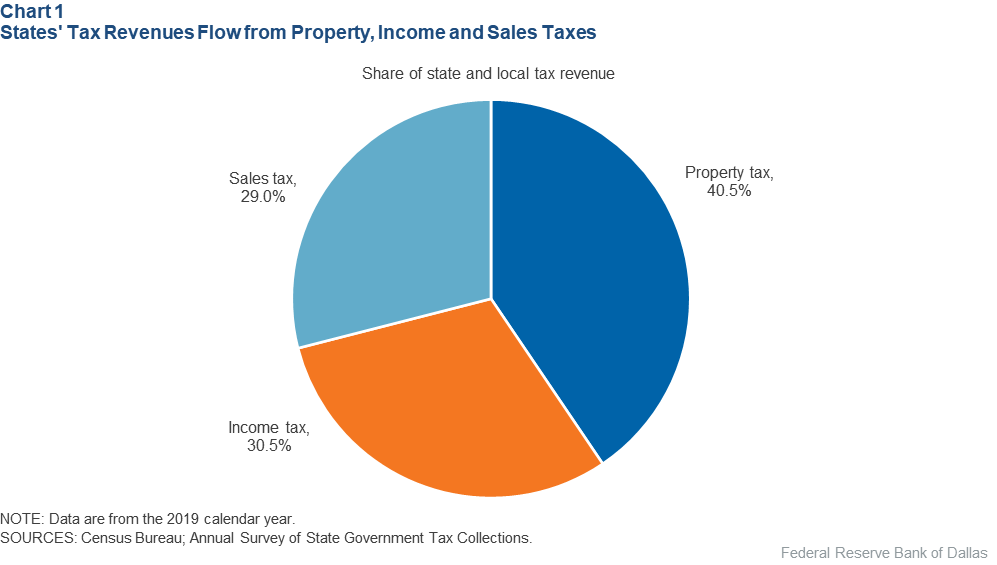

Federal Support Keeps State Budgets Including Texas Healthy Amid Tumult From Covid 19 Induced Economic Ills Dallasfed Org

How To Charge Your Customers The Correct Sales Tax Rates

How To Charge Your Customers The Correct Sales Tax Rates

What Is The Dallas Texas Sales Tax Rate The Base Rate In Texas Is 6 25

How To File And Pay Sales Tax In Texas Taxvalet

Texas Sales Tax Small Business Guide Truic

Texas Sales Tax Guide For Businesses

2021 2022 Tax Information Euless Tx

What Is The Dallas Texas Sales Tax Rate The Base Rate In Texas Is 6 25

Texas Income Tax Calculator Smartasset

How To Charge Your Customers The Correct Sales Tax Rates

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity